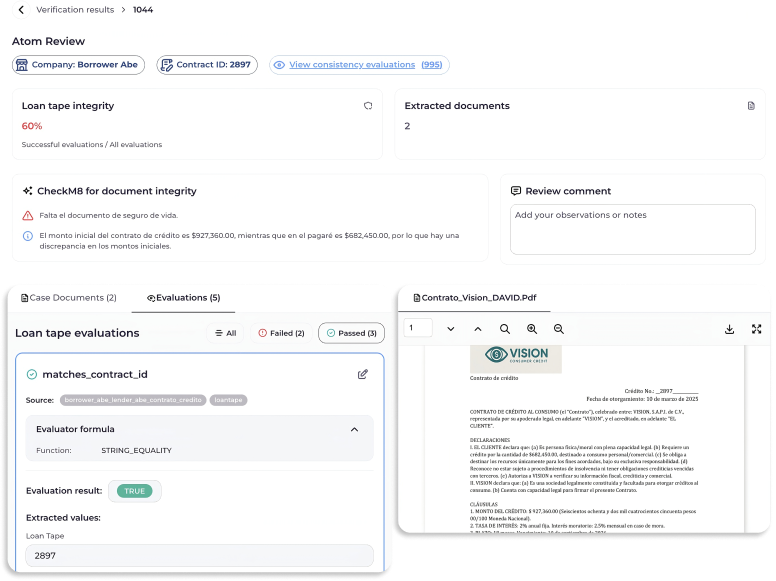

Document verification

Operational risk

Use of contracts, tapes or reports with errors that distort portfolio data and trigger incorrect calculations or decisions.

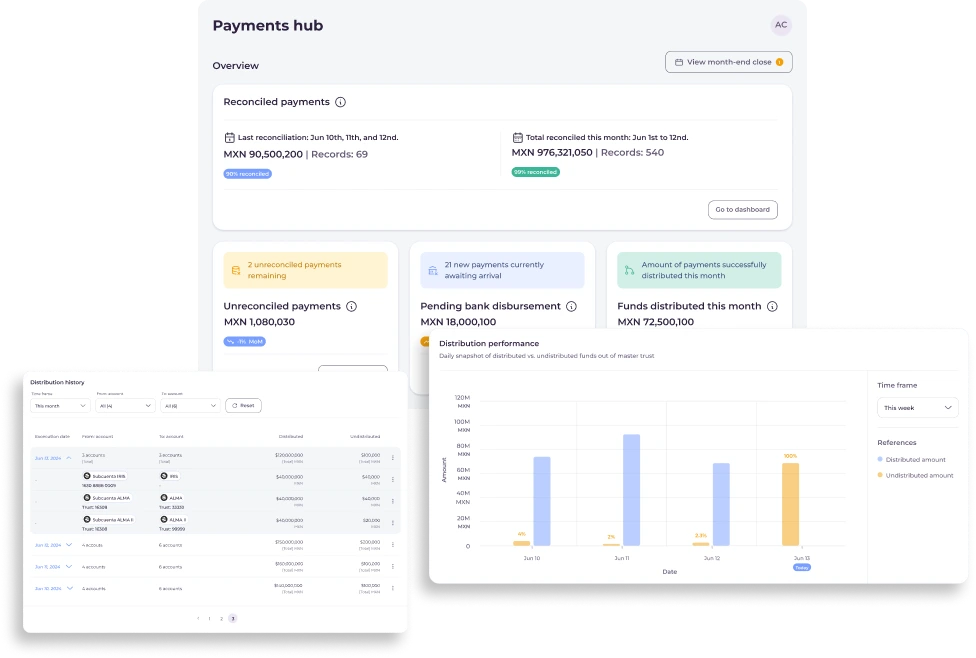

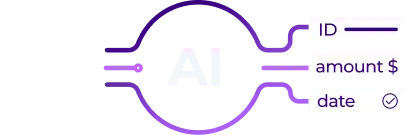

What Vaas does

We digitize and structure 100% of the credit file using automated extraction and accounting validations to flag critical inconsistencies from onboarding.