Simplifying debt management with Slack notifications

At Vaas, our commitment to democratizing access to credit in LATAM extends to simplifying the credit management process. We utilize tools like Slack to enhance communication with our clients, making debt management more efficient.

However, we understand that managing a line of credit is a complex task that involves keeping track of many things, not only on a monthly basis, but also on a weekly and even daily basis. Keeping up with all these different components without a tool to help can be exhausting for both borrowers and lenders.

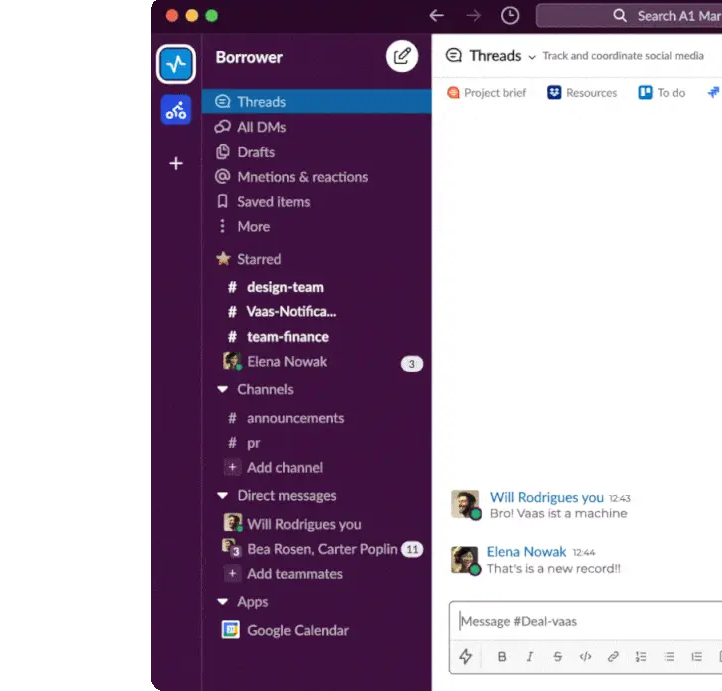

To help with this, we have developed Slack notifications. By using Slack, a platform widely used by our clients, we offer an easier and more convenient tracking system for credit lines. Our Slack bot will take care of sending automatic messages, including reminders for tasks, updates, document signing, and real-time notifications to avoid delays in cash flow.

The advantages of our Slack notifications are substantial:

Stay Informed: Clients can now stay up-to-date on all relevant events pertaining to their credit lines, eliminating unpleasant surprises and keeping them informed about crucial requirements.

Task Management: From generating reports to signing essential documents to meet lender requirements, our notifications guarantee that no critical task is forgotten or left incomplete.

These innovations bring us closer to our goal of empowering our clients to place capital orders or release cash faster than ever before, allowing them to focus on what truly matters. At Vaas, we're not just dedicated to democratizing access to credit; we're also committed to making credit management as efficient and stress-free as possible through effective solutions like Slack notifications.